Summary

- Ethiopia dominates the African aviation industry with the highest fleet market value, even though it doesn't have the most aircraft in Africa.

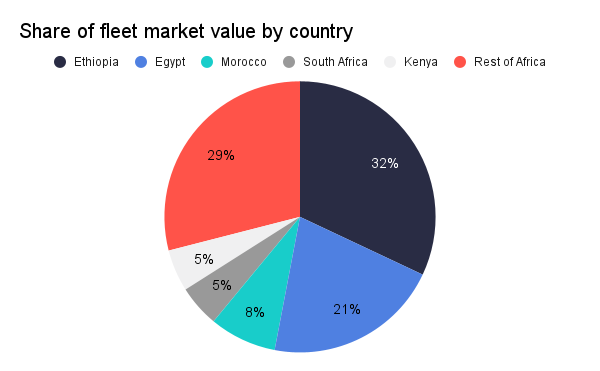

- The top five countries, including Egypt, Morocco, South Africa, Kenya, and Ethiopia, account for over 70% of the total African fleet by market value.

- African airlines are expected to start taking delivery of newer and higher-value aircraft in the next five years, with Ethiopian Airlines leading the way with the most firm orders.

Africa is the world's second-largest continent by land mass and population and a region with immense aviation potential waiting to be unlocked. Its various regions are associated with their own characteristics and players, but overall, Ethiopia is the market leader in aircraft fleet value, standing at $5.25 billion. An analysis of the African air transport market by AviationValues shows the continent's largest markets and the distribution of the passenger aircraft fleet in 2023.

Africa fleet count and market value

Africa is home to over 100 airlines operating scheduled flights to several domestic, regional, and international destinations. However, the top ten airlines account for over 50% of passenger traffic, while about 80% of air travel is provided by international carriers.

Regarding the number of commercial passenger narrowbody and widebody aircraft, Africa constitutes only about 2.33% of the global fleet, while the market value is slightly lower at 2.23%. Over the past four years, the split by market value has constantly been lower than the split by fleet count.

The percentage of the African fleet steadily declined between 2020 and 2022, while the gap between fleet count and market value proportion increased. This period saw only a few deliveries of high-value aircraft, including three A350-900s to Ethiopian Airlines and one A330-800 to Uganda Airlines. However, 2023 has been a year of recovery driven by ET's delivery of three high-value widebody aircraft.

About 200 high-value widebody aircraft were delivered to the rest of the world between 2020 and 2022, while about 86 have been delivered in 2023.

Ethiopia leads the African aviation industry

The East African nation has the highest market value, which is unsurprising, as the national carrier Ethiopian Airlines (ET) continues to dominate. While the country does not house the most aircraft in Africa, ET has the largest fleet, comprising several high-value models.

Ethiopia's current market value of $5.25 billion is about 32% of the continent's total fleet value. According to ch-aviation.com, the national carrier's fleet comprises 119 passenger aircraft, with 89 narrowbody and widebody jets and 30 turboprops. This includes 14 Boeing 737 MAXs, 18 787 Dreamliners, and 20 Airbus A350-900s, its highest-value aircraft.

Ethiopia vs The Rest of Africa

Egypt, Morocco, South Africa, and Kenya join Ethiopia in the top five. Ethiopia's market value is nearly 50% larger than second-ranking Egypt ($3.53 billion) and higher than all countries outside the top 5 combined. This is particularly interesting, as the East African nation has about 66% of Egypt's fleet less than 25% of the total African fleet.

The chart above shows that operators in the top five countries account for over 70% of the total African fleet by market value. Egypt's market value is driven by the national carrier Egyptair, which has a fleet of 75 passenger aircraft. The country's fleet has been growing over the years, but the market value only increased significantly in the last 12 months. This is because of the new A320neos and Embraer 190s delivered to Egyptair and Air Cairo.

The fleet count in Morocco and Kenya has remained sturdy over the past four years, but fleet value has decreased. Both national carriers, Royal Air Maroc and Kenya Airways, have not taken delivery of new high-value aircraft in large numbers, reflecting their financial troubles. However, they both have fleet enhancement plans in place.

South Africa's fleet value has declined since the start of the pandemic due to the downfall of the flag carrier South African Airways. Down there, the fleet value is driven by the private sector, with Airlink and FlySafair dominating the market.

Did you know we also have an aviation YouTube channel here?

Future outlook

The significant difference between Africa's fleet count and market value proportions is justified by the fact that Africa operates some of the oldest aircraft in the world, with the average age ranging between 17 and 19 years. However, several carriers are expected to start taking delivery of newer and higher-value aircraft over the next five years.

AviationValues found 152 firm orders for narrowbody and widebody aircraft placed by African operators. This is a mere 0.7% of the current global firm order backlog. Ethiopian Airlines tops the list with orders for 51 aircraft, including 10 A350s, 30 737 MAXs, and 11 787s. Air Peace, Air Algérie, Air Mauritius, Ibom Air, and Royal Air Maroc also have firm orders for new aircraft.

ET plans to almost double its fleet by 2035 and compete among the world's best airlines. TAAG Angola Airlines has a similar strategy, with plans to add more than 25 new planes by 2027. Similarly, Morocco's RAM plans to quadruple its fleet to operate at least 200 aircraft by 2037. These airlines have already begun placing orders for new aircraft, showing a positive outlook for the African air transport market.

What do you think about the market value of African operators? Please share your thoughts in the comments!

Source: AviationValues, ch-aviation.com